A Tale of Two Cities: Navigating the Office Sector in a Hybrid Work Era

INTRODUCTION

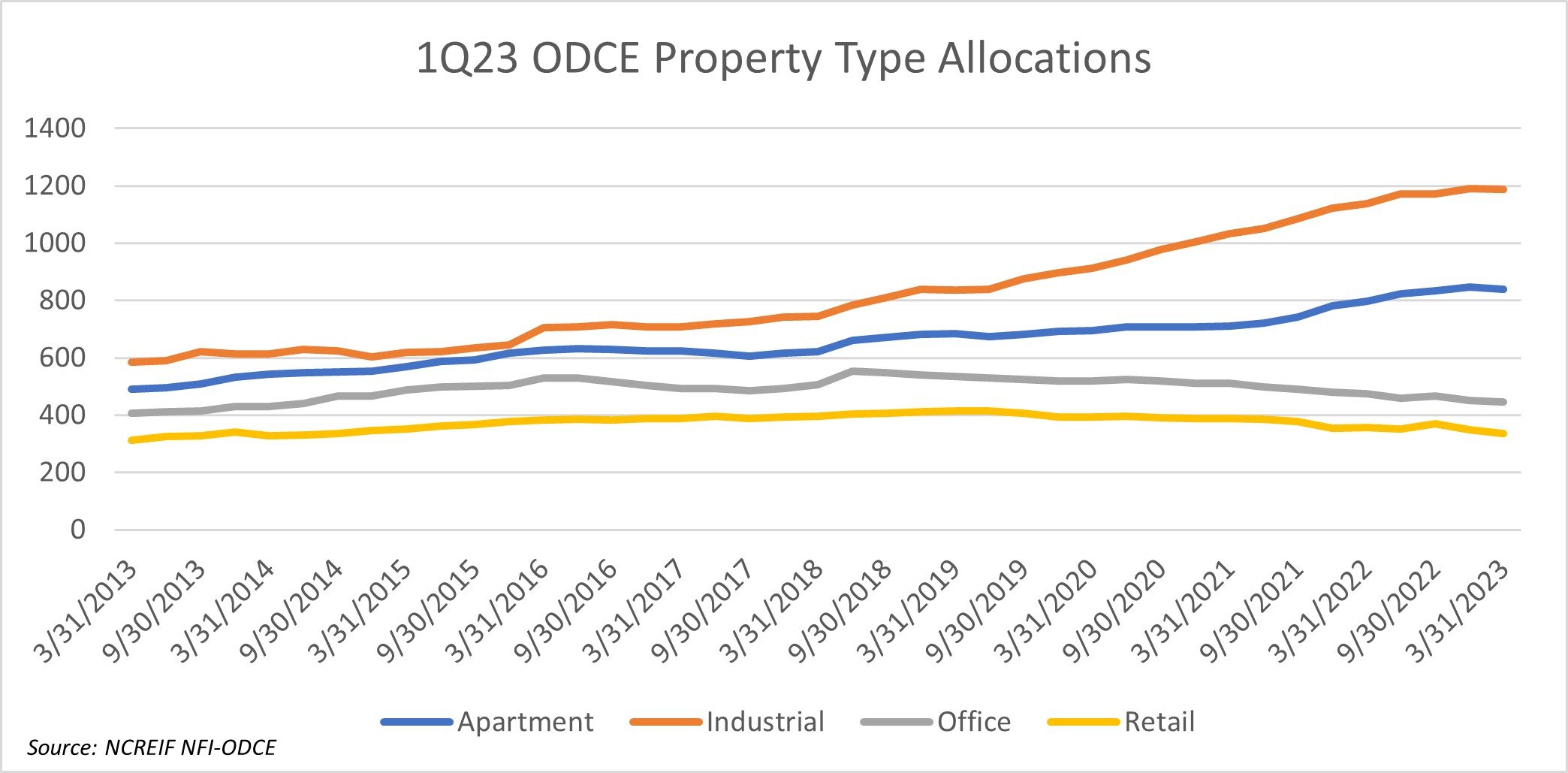

The office sector has been an integral part of investment portfolios for decades, but with recent trends and market conditions, there has been a steady decrease in office exposure in portfolios over the last 5-10 years, as shown in the below graph. The Covid-19 pandemic in 2020 exacerbated the office sector's decline as many U.S. companies were electing to have their employees work remotely or in a hybrid structure. Despite the waning of the pandemic, the desire among employees for hybrid/remote work remains strong. According to Zippia, 74% of U.S. companies are using or planning to implement a permanent hybrid work model. Furthermore, remote work has surged to seven times its pre-pandemic levels, underscoring the need for companies to provide flexible work arrangements to attract and retain employees. Remote work has become such a prominent factor in offices around the world that a recent McKinsey Global Institute article states that in nine major global cities they studied, remote work is anticipated to wipe out $800 billion in office values by 2030.

How has this trend impacted the office sector as a whole? Remote and hybrid work, mixed with layoffs, lower job growth and higher interest rates, has increased office vacancies and decreased valuations. An article published by NAIOP states that the U.S. national office vacancy rates reached 17.8% at the end of the first quarter in 2023, the highest since the second quarter of 1993. Some cities, like Los Angeles, are even seeing vacancy rates over 30%, according to Bloomberg. In tandem with the rise in vacancies, office valuations have experienced a decline. According to the NCREIF Property Index, the office sector recorded a -4.06% total return year-to-date in the first quarter of 2023, including a -5.20% depreciation. It also recorded a one-year -10.60% unlevered return in the NFI-ODCE for the same quarter. These figures represent the lowest performance among the five major property sectors during that period. Tenants continue to reduce office space, described in a Colliers market report which suggests that upwards of 300 million square feet could be unoccupied by 2026 in the U.S. (Colliers). Amidst the challenging landscape of the office sector, investors who display patience and persistence may uncover favorable long-term returns by identifying pockets of opportunities in select markets and assets.

In this blog, Alliance Global Advisors examines the implications of declining space requirements on office fundamentals and the potential repositioning of office assets. We will explore the effects of evolving work trends on companies, particularly with their capacity to maintain a collaborative culture. Additionally, we will provide valuable insights and best practices for companies that have opted for a hybrid/remote work structure. We would like to thank Tiffany Gherlone, Managing Director and Head of Real Estate Research and Strategy from UBS, and Lori Hill, Senior Vice President of Investment Management from Unico Properties, for their contributions to this blog and supplying further insight into the office sector.

MACRO: HOW HAS THE MARKET REACTED AND CHANGED IN RESPONSE TO THE DECLINE IN DEMAND FOR OFFICE?

The office sector has seen a divergence in the last three years as there has been a flight to quality where B- and C-Class offices are less in favor as a result. Hybrid and remote work are in full bloom, and employers continue to grapple with ways to attract their employees back into the office by offering newer, amenity-laden workspaces. Office tenants continue to consolidate and concentrate to major CBDs as location remains critical, favoring amenity-rich Class-A office properties. A survey conducted by Cushman & Wakefield found that nearly two-thirds of office occupiers plan to reduce their real estate footprint in the next two years while simultaneously looking to optimize their current space with amenities and services. As a result of this trend, certain companies are embracing a co-working model, wherein they or their employees rent office spaces on a flexible, membership basis. These co-working space providers such as WeWork, COhatch and Industrious have witnessed a surge in demand since the pandemic. This heightened interest stems from employees seeking the flexibility to work remotely while retaining the option to access nearby office spaces when desired. Companies are discovering that this model is more cost-effective and efficient compared to leasing an entire office space.

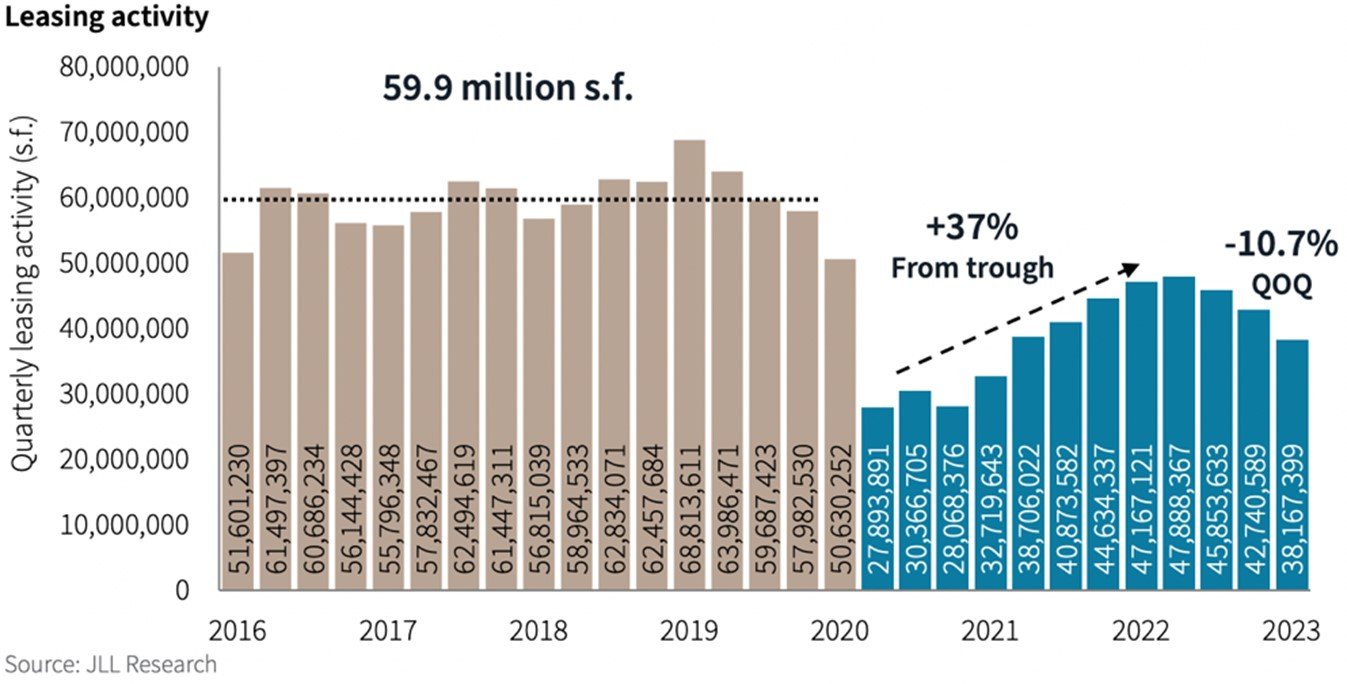

What are B- and C-Class office owners and managers doing to combat the flight to quality? According to JLL, leasing volume in the first quarter of 2023 experienced a decline of 10.7%, marking the third consecutive quarter of decelerating demand. Managers are taking note of the slowing demand and recognizing that tenants now hold the upper hand. Therefore, managers are proactively providing concessions to their tenants, such as implementing new lease structures, deferring rent collections or offering tenant improvement allowances. Tenants are negotiating for greater flexibility in terms of force majeure and are seeking stronger termination rights. An IREI survey found that 80% of landlords anticipate greater lease agility in the medium- and long-term where occupiers will be able to grow and shrink their office footprint within a single contract. Furthermore, tenants can secure a greater discount than before the pandemic, with some markets seeing tenants achieving up to a 20% discount in addition to more favorable lease terms.

What is the future of the B- and C-Class offices that are struggling with elevated vacancies? The increasing demand for multifamily properties due to limited single-family residential inventory and its correlated affordability in the wake of the pandemic makes the prospect of office-to-residential conversion a desirable and logical option for building owners. Many metropolitan and suburban markets are evaluating these conversions to satisfy two objectives – the current lack of residential inventory and repositioning materially vacant office properties. The common question asset owners are mulling over is whether these conversions to residential are sustainable and practical. Lori Hill states, “Data shows that there has been an increase in the number of office-to-residential conversions, and political and social forces are at work to incentivize conversions to residential. However, there is a high degree of complexity to conversion projects that makes it difficult to scale as a strategy, so the trend is likely to remain more of a one-off situational approach.” Not every office building is ripe for conversion and property owners need to consider floorplate layout, existing infrastructure, exterior envelope including window lines, availability of amenities and overall appeal from an appearance perspective.

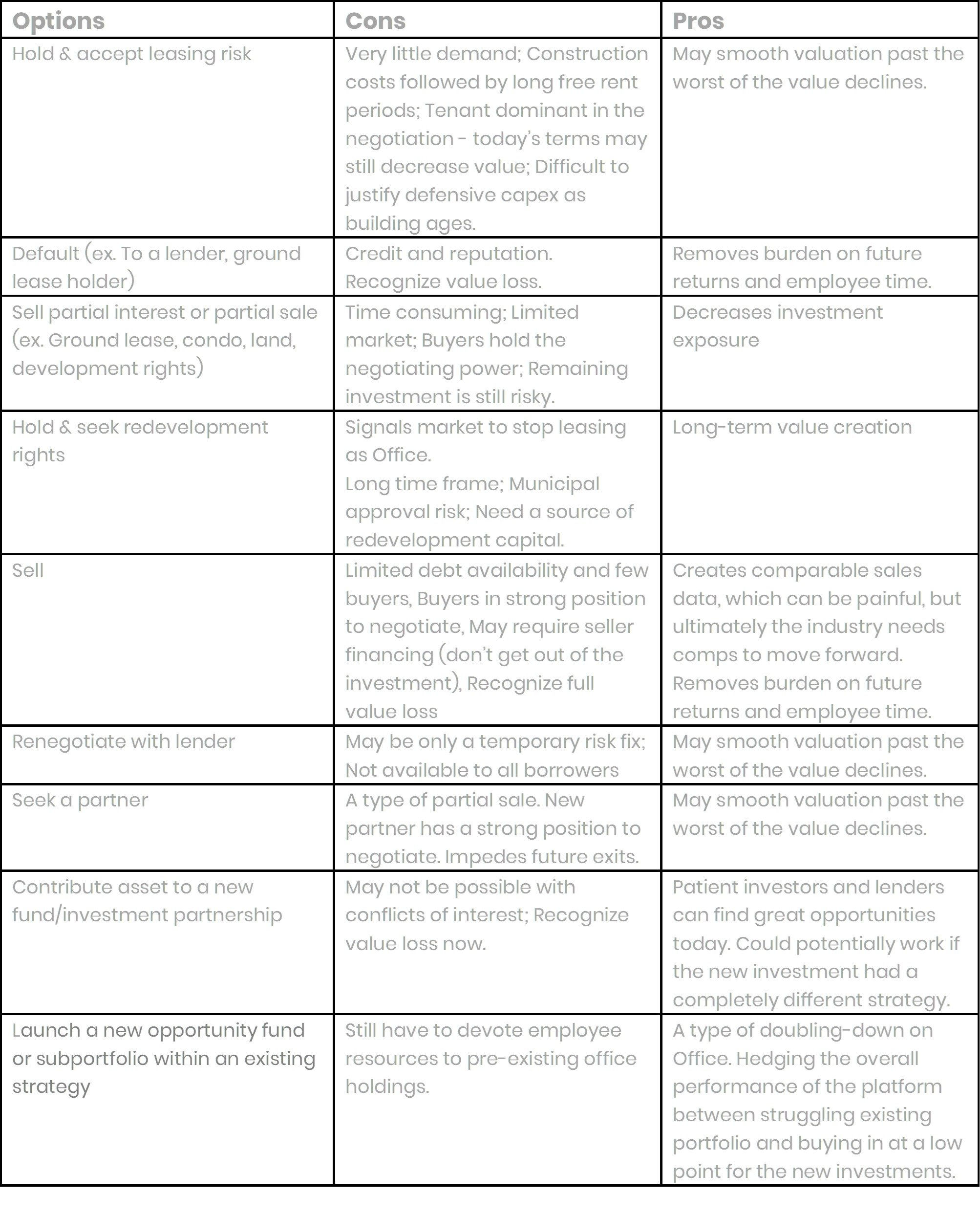

Tiffany Gherlone opines on the current climate of the office market and different scenarios to consider as an office building owner. Please find below a sample of the many directions to take future ownership and the associated consequences:

MICRO: HOW ARE THE NEW OFFICE WORK TRENDS IMPACTING COMPANIES AND THEIR WORK CULTURE?

The increase in hybrid/remote work has quickly changed the landscape of company cultures, making it increasingly difficult for employers to build and maintain strong, cohesive cultures. The inability to have all employees in the office simultaneously creates various communication issues, both between employers and employees, as well as colleague-to-colleague. The lack of face-to-face interaction can lead to misinterpretations, misunderstanding of non-verbal cues or delays in responses. The days of dropping by a colleague's office for a quick question are becoming increasingly rare. Instead, the norm has shifted to relying on emails or scheduling Zoom calls, with the hope of receiving a prompt response from the person on the other end. This delay greatly impacts the collaboration of the company culture and can lead to reduced efficiency throughout the company. The new work trends have also led to reduced spontaneous interactions in the office. Coffee breaks, hallway conversations or eating lunch together often lead to idea-sharing and problem-solving, and the lack of such exchanges reduces connectivity and the flow of ideas.

Employee production levels with the hybrid/remote structure have become a talking point amongst many company leaders. There is a growing fear that without the direct supervision of office leaders and distractions at home, employee production will decline. In a new study released by Microsoft, 85% of leaders say that the shift to hybrid work has made it challenging to have confidence that employees are being productive. Along with this, 49% of managers of hybrid workers “struggle to trust their employees to do their best work” (Microsoft).

Though this narrative is popular amongst company leaders, studies have rebuked these thoughts. A two-year survey by Great Place to Work, which surveyed over 800,000 employees, showed that “shift to working remotely in the pandemic boosted worker productivity by 6% on average”. On average, across a group of six surveys, remote work productivity was more than 7% higher than in-office.

BEST PRACTICES FOR HYBRID AND REMOTE COMPANIES

If a company is electing to move to a hybrid/remote work structure, what are the best practices to ensure full productivity and collaboration? Alliance Global Advisors, founded in 2020, was created and currently operates as a fully remote company. As such, Co-Founders & Managing Partners, Jennifer Stevens and Heather Fernstrom Border, have first-hand experience in developing and maintaining an efficient and synergistic remote culture. Jennifer Stevens comments on the unique working model Alliance embraced upon launch, "Alliance Global Advisors launched at the onset of the global health pandemic. At that time, we intentionally opened a physical office space in Naples, Florida. Simultaneously, we focused on building a high-quality team of people who are geographically positioned in remote regional pods. This structure allows our team to be in the office, and more importantly together in the markets where our clients reside. It also provides our team with additional flexibility when it comes to family-care, travel and work. Culturally, our team embraced a communication framework that allows us to stay connected and attract high-quality talent to our unique model. In addition to more frequent regional meet-ups, we also gather the entire team in Naples (or another fun location) for bi-annual retreats to focus on team-building, culture-building and important strategy sessions. This framework only works with a high-quality and performance-oriented team in a company with cohesive values. We're fortunate our team fits that mold."

In the last three years, Alliance has found that adhering to these best practices helps to create a strong, unified company culture:

Emphasize the importance of communication throughout the company: Encouraging open communication with all levels of the company is key to fostering effective collaboration. Ideas, perspectives and problem solving are communicated more frequently, leading to more production

Leverage communication and collaboration tools: Utilization of email, instant messaging and video conferences allow for seamless communication and teamwork

Develop remote working policies: Without the supervision of superiors, it can be difficult for employers to keep track of employee work and progress. Developing guidelines centered around hybrid/remote work helps provide a more structured work culture, even from afar. This can include expectations regarding working hours, production and response time

Provide regular performance feedback: It can be difficult for remote employees to gauge their performance due to nonverbal communication barriers and less one-on-one meetings. Encourage quarterly or bi-annual performance evaluations. This also allows the employee to voice any concerns or issues they may be having

Foster virtual team-building activities: Hosting virtual social hours or lunch breaks together can help build team connections

Invest in employee engagement initiatives: Alliance has a team retreat twice a year so that all team members can spend time together in person. These retreats help further build our relationships

Create a thorough remote onboarding process: It’s essential to provide remote team members with all the tools and resources needed to excel at their position as if they were working in the office. This includes equipment, databases, online tutorials and more

Have the senior-level employees set the example: Whether this is through increased production when working remotely or being in the office more often than required with a hybrid structure, it’s important for the senior employees to set an example for the junior employees to follow

FUTURE PROJECTIONS AND INVESTOR OUTLOOK

The Investor outlook for the office sector continues to be pessimistic, and there is a growing apprehension that significant decreases in office valuations will lead to a surge of distressed assets. This, along with the reasons laid out in this blog, is hampering this sector’s ability to fully make a recovery post-pandemic. NAIOP projects demand and net absorption for office to continue to shrink into early 2024. Despite these challenges, there are signs that point to investment opportunities and a potential recovery in the coming years. As part of NAIOP’s projections, a bounce back in mid-to-late 2024 is expected for this sector, where we may see positive demand and net absorption. A JLL report states, “Capital markets impacts have been significant and are starting to create distress, which will continue as the cycle plays out, but some degree of distress will allow a resetting of the basis on office investments, which will enable further investment in properties—helping to respond to what continues to be strong demand for high-quality differentiated offices”. Opportunities lie within newer office spaces, particularly those constructed from 2015 onwards. The same JLL report found that those vintage office buildings are posting consistent occupancy gains, with an additional 6.6 million square feet of net absorption. Investors will find long-term returns in the office sector, but they could be limited to the right type of asset and market that exhibit strong credit tenants, high occupancy rates and long-term-remaining leases. Lori Hill and Unico Properties echoed the same sentiment, “We believe the recovery in the sector will be stratified, so a selective approach to market and micro market selection, as well as asset selection, is key to successfully capitalizing on the current distress.”

CONCLUSION

The pandemic has created a major rift in the office sector in the last three years causing Investors to decrease their office exposure. The challenges in the office sector have been further compounded by the rise of hybrid and remote work. This is evident in the performance of the office sector in the NCREIF Property Index, as more employees opt to work from home, resulting in companies downsizing their office spaces and favoring offices with abundant amenities. Company cultures and employers must adapt to these evolving work dynamics as they seek strategies to uphold team collaboration and productivity.

Despite the challenges faced by the office sector, there are still pockets of opportunity for investors in select markets. While these opportunities may not carry the same weight as before, they can still provide stability and long-term returns.

ABOUT ALLIANCE GLOBAL ADVISORS

Alliance Global Advisors is a women-owned consulting firm focused on empowering the institutional investment community to elevate best practices. Advising clients with over $520 billion in assets under management, Alliance partners with organizations to provide an independent perspective and innovative approach to critical strategic initiatives. Our partnerships allow senior management teams to focus on what matters most: diligently managing client capital, creating value and delivering exceptional returns in a performance-driven market.

Disclaimer: This blog was originally published in July 2023 and will be updated periodically to reflect changes in the industry. The content may contain or cite personal and/or professional opinions that differ from the views of Alliance Global Advisors.