Tech-Readiness: The New Investor Test

Introduction

Across the investment management landscape, “tech-enabled investment management platform” is a phrase that appears with increasing frequency. Yet the meaning behind it varies widely.

What is clear is that investor expectations have changed and they are asking more sophisticated questions about how managers use technology to enhance accuracy, returns, efficiency and transparency. In many ways, technology has shifted from a value-add to a baseline competency that influences how managers are evaluated during operational due diligence and partner selection.

At Alliance Global Advisors (Alliance), we advise investment managers on how technology readiness signals institutional maturity and influences credibility with investors and consultants. We understand the competitive landscape and how managers, operators and developers are using technology to create a competitive edge. This blog addresses current market dynamics and how managers can prepare, compete and differentiate as investor expectations evolve.

Alliance continues to develop solutions to help investment managers better evaluate and strengthen their technology infrastructure across the asset, portfolio and organizational levels. As investor expectations evolve, we are exploring strategic partnerships and advisory frameworks that will enable our clients to assess their technology readiness, identify gaps and make informed decisions about how tools and systems can support scale, efficiency and digital communication. This work is ongoing, and we look forward to sharing more as it progresses.

If you are interested in how Alliance is approaching this space or want to learn more about our early efforts, let’s connect.

We are grateful to Sourav Goswami from Forty5Park and Zander Geronimos from PRODA LTD for contributing to this blog. Their insights helped shape our view of where the market is heading and how managers can stay ahead.

“Real estate deals are won or lost on the razor’s edge of basis points, and the next advantage will come from compounding intelligence, not more spreadsheets and dispersed tribal knowledge.” Forty5Park

Why Investor Expectations Have Shifted

As investment platforms expand across strategies and geographies, investors want greater clarity into how organizations govern data, manage information and communicate performance. The key questions are no longer simply about tools. They focus on how technology supports decision-making, transparency and scale.

Investors and consultants are increasingly evaluating:

Accuracy and consistency of reporting outputs

Ability to scale without operational strain

Cybersecurity and information governance practices

Integration of data across investment, asset management and finance workflows

How technology supports the investment thesis and value creation strategy

Managers who articulate a clear, well-governed technology approach are better positioned to build trust, shorten diligence cycles and compete for capital.

Why might it be helpful to have a firm involved that understands all aspects of investment management (asset, portfolio, corporate-level needs) when evaluating the technology stack vs. a traditional IT service provider? What gaps exist when a different route is taken?

Sourav Goswami: “Because technology alone does not create an edge in institutional real estate. Understanding how capital truly gets deployed does.

A systems integrator can spin up dashboards. They cannot evaluate a JV waterfall, understand the nuance in an offering memo, pressure test underwriting assumptions, or anticipate the investment committee debate. A team that has lived through the workflow knows where alpha is created and where expertise breaks down under time pressure. This “symbolic” logic that is specific to real estate MUST be embedded into any solution of value to real estate fund managers.

We did not slap a generic wrapper on top of a large language model and call it “artificial intelligence.” We create that vertical industry understanding through our neurosymbolic approach. This is the same reason HarveyAI has had such success in the legal industry.”

Zander Geronimos: “Over the last decade, we have seen a shift from technology being a back to middle office with a focus on operations to being a core element of generating opportunities and executing on deals. Therefore, teams that have fully embraced innovation across all teams are able to not only reduce costs in down cycles but can execute on deals at a faster pace than teams in a traditional IT schema. The ‘first movers’ on technology in this age of proptech are outperforming their peer set with excellent talent and a full cycle technology framework.”

What Managers Are Prioritizing Today

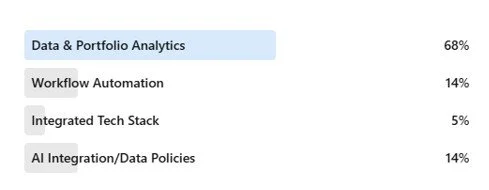

Based on our research, managers are prioritizing four areas of focus:

Data Analytics and Portfolio Insight: Using real-time data to support underwriting, asset management and performance monitoring.

Organizational Efficiency and Workflow Automation: Reducing manual processes to create consistency, accuracy and capacity.

Integrated Technology Stack: Ensuring systems connect and speak to one another rather than operate as standalone tools.

Cybersecurity and Responsible AI Use: Protecting sensitive information and establishing policies that define how AI can be used responsibly.

What’s the top priority for your organization when it comes to technology and AI in investment management?

What services are needed that do not currently exist for investment managers in the advisory solutions space?

Sourav Goswami from Forty5Park: “A system that sits between a data warehouse and a human brain. A platform that understands fund mandates, debt structures, tenancy, macro context, and how actual IC conversations unfold. And advisory that does not come in decks that collect dust but in embedded intelligence that learns from the firm and compounds over time. Real estate needs its HarveyAI moment. We are building that connective tissue. The intelligence layer that turns dark data into alpha.”

Zander Geronimos: “Standardized training and policy to enable investment managers to utilize off the shelf platforms as well as generalist AI toolkits. There is a race for each manager to either open or control the use of tools; however, a missing piece is a single standard policy for teams to leverage. Organizations like OSCRE are setting a data standard across schemas in real estate but can be leveraged to incorporate in usage policy and interventions across systems that investment managers can utilize as they continue to embrace these new tools.

Challenges Firms Must Navigate

Even when the value is clear, execution is rarely straightforward. We observe several common challenges:

Mapping current workflows to involve the right stakeholders and guide what to keep or modernize

Determining which technology investments will generate meaningful impact

Aligning internal teams to adopt new workflows and systems

Deciding whether to build capabilities in-house or outsource

Balancing speed of adoption with governance, oversight and compliance

Making progress without overwhelming bandwidth, particularly for boutique and mid-sized firms

Technology is only effective when it is embedded into how the organization works, not layered on top of existing processes.

What mistakes are you observing happening in this space right now, and how can we help to address those mistakes?

Sourav Goswami from Forty5Park: “The industry is modernizing tools, but not thinking. Automating tasks with point solutions, without elevating judgment through broader infrastructure. Buying software instead of building intelligence. The mistake is believing AI replaces investors, whereas the future is investor plus AI. Pattern recognition plus industry-specific knowledge and understanding. Scale plus judgment.”

Zander Geronimos “Teams are mandating AI without defining the outcome and focusing on fundamentals. Executives are feeling the pressure that they need to have an answer with AI but are not identifying the why and by not implementing fundamental changes to data workflows and collections, ultimately will lead to failures in AI tools which require good data to train on. A mandate to deploy without clean structure or a thoughtful outcome inevitability leads to tech fatigue and failure.”

Opportunities for Differentiation

The managers gaining momentum are simply not using more technology. They are using it more intentionally.

Successful use cases include:

Automated reporting frameworks that reduce operational burden

Firm-wide data environments that create a sole source of truth

Portfolio dashboards that improve risk awareness and oversight

ESG data integrated into core portfolio analytics rather than maintained separately

Prediction modeling and factor analysis being used for market research and underwriting support

Investors consistently highlight managers who can demonstrate how technology improves their ability to execute their strategy, not just how it improves internal operations.

“We’re seeing a clear shift in how institutional investors and consultants consume information,” said Masha Rzoski, Vice President of Marketing at Alliance Global Advisors. “They will grow to expect marketing collateral (ranging from broker materials to marketing presentations and website adaptations) to be dynamic, visual and immediately accessible. Digital-first marketing is not just about modernizing presentations, it is about enabling faster understanding and building conviction. Managers who embrace this shift will create stronger engagement and stand out in an increasingly competitive landscape.”

Preparing Teams to Support Technology and AI

As technology strategy evolves, human capital strategy must evolve alongside it. Many managers are actively determining how roles, responsibilities and training programs should shift to integrate data and AI-enabled tools.

Organizations are evaluating:

Which tasks should remain human-led vs. machine-supported

How analysts and asset managers can use new tools responsibly

What training and enablement look like across seniority levels

How to align performance expectations with new workflows

Technology alone does not improve outcomes; people must use it with discipline and judgment.

AI: An Area of Exploration, Not a Final Destination

AI is now part of strategic planning discussions across the industry. Yet most organizations are in the early stages of determining where AI can be useful and where governance is required.

Emerging considerations include:

Training teams on appropriate and responsible use

Reviewing legal guidance around licensing and data sourcing

Ensuring proprietary data is not exposed via personal AI tools

Establishing clear approval and documentation procedures

Defining which workflows AI can support rather than replace

It is also important to note that using personal AI accounts (e.g., ChatGPT personal) can unknowingly expose firms to data leakage and liability, particularly if investment models, client data or board materials are used as prompts. Legal and compliance teams are increasingly developing firm-wide AI access protocols to manage this risk.

Different levels of adoption may include:

Asset Level: Underwriting support, leasing analytics, IoT patterning

Fund Level: Performance monitoring, scenario testing, portfolio modeling

Organizational Level: Research acceleration, marketing drafting, CRM analytics

For many managers, the priority is not widespread deployment, it is building clarity, governance and readiness.

Recognizing that data science and building software/internal applications are vastly different, what is the biggest misconception managers have when hiring data analytics teams to improve business intelligence?

Sourav Goswami responded, “That internal data science alone will create strategic advantage. Most internal builds turn into multi-year engineering science projects that get stuck in data cleaning, require constant maintenance, and are never adopted by deal teams. They ship dashboards. Not intelligence.

The belief is that technology itself is the moat. The reality is that compounding judgment is the moat. If a platform does not accelerate conviction and shorten the window where deals are won or lost, it becomes shelf-ware.”

Zander Geronimos: “The firms believe that they can build tools that outpace the innovation of the market. This will lead to a continuous investment in tools to compete with the market and not incorporate best in class tools their peers are leveraging. In this current age data analysts need more than a firm’s internal data and trained models but need to leverage the open markets tools. Build versus buy model now ultimately requires building off the industry’s shared platforms.”

What is the biggest opportunity for managers right now when it comes to implementing software solutions across their businesses?

Sourav Goswami: “Unlocking the $90B of dark data created every year, and then allowing it to be easily queried and benchmarked against the external data firms buy or commission. This is truly the compounding of institutional intelligence using massive amounts of computational power. The firms that will win are not the ones who decide to hire tech consultants to digitize files. They are the ones building an infrastructure to connect the internal and external knowledge and data from their various point solutions into an operating system that then elevates the advanced pattern recognition to cognition…the ones who move from “data at rest” to “data in motion” to fuel better and faster decisions. When underwriting cycles and disposition decisions compress by weeks, that is not just a convenience. That is how you bring a fighter jet to a knife fight.”

Zander Geronimos: “As we review the historical records of data that remains on multiple stagnant formats can finally be reviewed, cleaned and standardized alongside simple integrations reducing friction of all selected technology stacks. Ultimately, this is the opportunity to clean the hundred-year backlog of property information and the breakdown of technology deployment of the last 30 years. This moment is the inflection point to fix the plumbing.”

Conclusion

The goal is not for investment managers to become technology companies. The goal is to ensure the organization can scale with control, communicate with clarity and demonstrate discipline to investors. Technology readiness has become a signal of institutional maturity, and managers who approach it strategically are better positioned to compete and differentiate.

Are you interested in technology consulting or understanding how the competitive landscape is utilizing technology to gain an edge? Let’s connect.

ABOUT ALLIANCE GLOBAL ADVISORS

Alliance Global Advisors is a women-owned consulting firm focused on empowering the institutional investment community to elevate best practices. Advising clients with over $970 billion in assets under management, Alliance partners with organizations to provide an independent perspective and innovative approach to critical strategic initiatives. Our partnerships allow senior management teams to focus on what matters most: diligently managing client capital, creating value and delivering exceptional returns in a performance-driven market.

ABOUT PRODA LTD

Proda is a data intelligence platform built for institutional real estate. The company transforms unstructured property data into clean, standardized and decision-ready insights, reducing manual work and improving accuracy across portfolios. By integrating seamlessly with investment, asset management and finance workflows, PRODA.AI helps managers uncover patterns faster, accelerate reporting and strengthen underwriting. Its platform enables real estate organizations to operate with greater clarity, efficiency and confidence in an increasingly data-driven market.

ABOUT FORTY5PARK

Forty5Park is an AI Platform for Real Estate. Forty5Park is building a neuro-symbolic* AI operating system, called askParker, to unlock dark data in institutional real estate. Dark data is the institutional memory and cumulative experience that lives inside models, PDFs, emails, IC decks, rent rolls, legal docs and analyst brains, but never reaches a decision point because it is unstructured, siloed or simply too hard to extract.

Real estate managers buy or generate $120+ billion of data each year, yet only use 5% of it for investment decisions. We turn that dormant intelligence into real-time investment advantage. This platform reads and reasons the way a world-class team of analysts and asset managers would, so sponsors can underwrite faster, see patterns earlier and turn information they already own into alpha.

* Neuro-symbolic AI is a hybrid approach that combines the strengths of neural networks (for pattern recognition from data) and symbolic AI (for logical reasoning and explainability). This fusion aims to create more robust, capable and transparent AI systems that can understand and reason about the world more like humans. This approach has significant potential in fields like healthcare and finance and is a key area of research to advance AI beyond current limitations.

Disclaimer: This blog was originally published in November 2025 and will be updated periodically to reflect changes in the industry. The content may contain or cite personal and/or professional opinions that differ from the views of Alliance Global Advisors.